Marrying a man is not a financial plan.

While we celebrate women’s achievements on International Women’s Day, it is a timely reminder to talk to women about financial matters and look at smart ways to gain financial independence.

Women are great savers but are somehow reluctant to take the plunge to invest to build wealth. They are generally perceived to be risk averse and more conservative in their investment approach and may largely prefer debt to equity, with post office RDs and FDR, being their favourites.

According to a report by UBS Global Wealth Management, Women worldwide tend to adopt a traditional approach in managing finances, where they defer to their spouses to manage critical, long-term planning.

Globally, 85% of women are highly involved with the short-term finances of their families, such as daily expenses, budgeting, and cash flow. However, 58% also leave decisions about retirement planning, insurance, and long-term care to their husbands.

The most frequently cited reasons include: “I think my spouse knows more about this topic than I do” (82%); “I focus on other responsibilities” (79%); “My spouse is the primary breadwinner” (78%), and “I’m not interested in planning and investing” (68%).

However, The demographics of women have changed rapidly in the 21st Century. Women are now a prominent component of corporate India and the global business landscape. Their emergence as leaders, entrepreneurs, and innovators has made them an integral part of our country’s economic health and the future of global business. More women are taking stewardship of family and business finances.

In very recent times, women have taken leadership position in most of the leading Indian Private and Public sector Banks, apart from other industries. Most business channels have women anchors and news editors who are doing a commendable job in enhancing financial awareness and bringing financial news analysis to our living room.

Women also are often seen as intuitive, thoughtful and compassionate, and can use these qualities to their advantage as they plan for the future.

In our experience of interacting with several women investors, they strive to be financially independent and financially literate. Women are a lot more data rational and do not make investment decisions on a whim. Instead, they require a lot of details about the product before they commit. Women tend to be more long-term investors and have a more disciplined approach. They also have a more rational approach rather than emotional when it comes to prioritizing goals.

While men approach markets with return maximization approach, women want risk minimization. We feel, it is the lack of knowledge that makes women risk averse. Many women feel intimidated and don’t want to participate in financial planning or management but in our experience, they handle volatility better than men, when they have knowledge.

In our opinion, women are not necessarily risk averse but see the future with more caution than men. So, women see needs and give priority to goals for emergency funds and insurance to handle unexpected setbacks.

They are more disciplined and committed to the financial goals and more concerned about the financial future especially related to contingency fund, children’s education and retirement planning.

We always try and meet our clients with both the partners present, during discussions regarding financial goals and reviews. We also prefer the ladies joining their spouse in IAPs (Investor Awareness programme) that we conduct regularly for families. Their presence ensures that we need to do lesser amount of follow up to enable investors to start their investment journey.

We’ve always been passionate about encouraging women to take an interest in their money, rather than taking it for granted or surrendering the responsibility to a partner.

Having seen friends struggle to make ends meet when the unexpected happens, we know first-hand how important it is to have an independent understanding of finances. This is especially true given the fact that women face a unique set of challenges compared to their male counterparts.

Women, more often than men, interrupt their careers to care for children, aging parents and grandchildren. Being a caretaker can save money but it comes at a huge cost, if care giving displaces a stream of income that a woman has to give up.

Women needs are different when it comes to financial planning and the main reasons for the same are; Women tend to live longer than men, (According to United Nations population estimates, the life expectancy for women in India is 69.8 years compared to 66.8 years for men.)

Women earn relatively less, as there is an income disparity between the wages for men and women, (women earn 20% lower than men, according to the Monster Salary Index (MSI).)

They also tend to spend lesser time in the workforce, have to take forced sabbaticals due to maternity and raising a family, taking care of the elderly etc.

Is money Important?

Yes, ladies, money is important because it gives you options, because it enables you to have more control over your life, more freedom to carve out your own path and less constraints on your choices. Having money enables you to live life to the fullest, Money buys you a more comfortable lifestyle,enjoy adventures and textures and tastes, and to make the most of the ~80 years you’ve got.

“Wealth is not about having a lot of money, but having a lot of options.”

Hence, Create wealth for the financial independence it gives you, for the freedom it gives you to follow your passion, to do what your heart desires, to face the world of uncertainty in this era of disruptions and change, and also to leave a legacy or contribute to society.

(Check out our earlier blog on the subject, https://www.sahayakassociates.in/resources/our-blog/2553-sahayak-associates/sahayak-associates-blog/8172-is-money-really-important)

Our sincere advise for all ladies, especially on this wonderful day is, As a young girl you may have watched your father take independent financial decisions for the family, as your mom remained quiet, but in present times, kindly be more assertive in matters of the wallet.The time for financial empowerment of women has arrived; you just need to focus on it.

Please understand your needs, financial requirements and what motivates you. Take charge of your finances today, Ask questions, and think about the details of your current financial situation and how your decisions might affect your financial planning now and in the future.

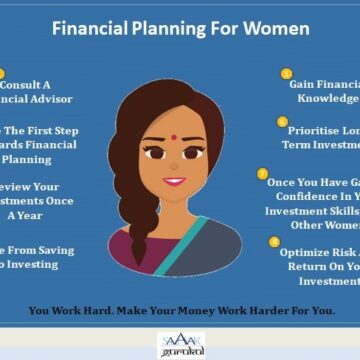

Gain financial knowledge, understand the options available, don’t ignore risk, and above all, be aware and involved in all financial decisions of the family and always be present in all financial discussions your husband has with his financial advisor

Finally, let me just reassure you, that you lady, with your disciplined and rational approach, will definitely end up doing a better job than your spouse, when it comes to family financial matters and planning for the future. As in all matters, you are not only equal but also superior to men in financial matters.

However, remember that, gaining financial knowledge and understanding the options is the first step to financial independence. Please don’t start on the journey and don’t take the car on the road before learning to drive.

A toast to all the lovely ladies, celebrate the elegance of Womanhood,

Here is wishing you a Very Happy & Prosperous Woman’s Day!

Happy Investing!!

Stay Blessed Forever

Sandeep Sahni

You may contact us at:

91-9888220088, 9814112988

sandeepsahni@sahayakassociates.com, info@sahayakassociates.com

Follow us on:

www.sahayakassociates.in, www.facebook.com/sahayakassociates, www.twitter.com/sahayakassociat, https://www.instagram.com/sahayakassociates/ https://sahayakgurukul.blogspot.com

Note: All information provided in this blog is for educational purposes only. They don’t constitute any professional advise or service. Readers are requested to consult a financial advisor before investing as investments are subject to Market Risks.