“Investors will go through the budget document and the Budget speech with a fine-tooth comb, looking for indications on how the government will tackle the slowdown and the path forward. Investors are keen to see a coherent economic game plan.

There is consensus among global investors that the time has come for a serious push to improve the business climate. If we do not see major reform steps to boost the economy now, given the economic weakness and the majority this government enjoys, there is little chance anything significant will happen later. For investors, this Budget will be a litmus test for judging the reform credentials of the government.”

The above was a summary of the investor sentiment and analyst calls before the budget 2020 was presented. Post budget, many analysts believe that a golden opportunity has been lost, despite the government having the mandate, macros being favourable and the top echelons making the right sound bytes pre budget and assuring all concerned of doing something spectacular before the budget. After the inspiring economic survey — a document that has zero-actionability but is supposed to be a reflection of the mind of government — was tabled in Parliament on 31 January 2020, the market expected serious efforts towards wealth creation, but alas, nothing substantial has been done and the economy has been left to fend for itself.

CEA K Subramanian in the Economic Survey said,“Wealth creation, through legitimate means, should come with a degree of pride, and not as an act of apology.”

He further quoted former RBI Governor Raghuram Rajan and Luigi Zingales’s book “Saving capitalism from the Capitalists,” warning against the dangers of regulatory capture by private interests.

He adds, “The root of wealth is economic activity and lack of it brings material distress. In the absence of fruitful economic activity, both current prosperity and future growth are in danger of destruction. A king can achieve the desired objectives and abundance of riches by undertaking productive economic activity”.

Kautilya advocates economic freedom by asking the king to “remove all obstructions to economic activity”.

The CEA takes refuge in Kautilya’s wisdom several times. “The King (i.e., the State) shall promote trade and commerce by setting up trade routes by land and by water, and establishing market towns and ports,” he quotes from the Arthashashtra in a chapter on Targeting Ease of Doing Business.

The Survey used ancient literature and contemporary evidence to drive home the point that India’s dalliance with socialismis an exception, with belief in the “invisible hand” of markets being the norm.

Based on the above and other such quotes, it was expected that the government will loosen controls, remove bottlenecks to growth and make major reform announcements in Budget 2020.

The Union budget document is a projection of the Income and expenditure for the upcoming year and lays out the priorities of the government. Analysts and economic thinkers like to look for direction in the figures to see which path the government wants to adopt to achieve the desired GDP growth.

Ideally the budget should act as a catalyst for growth, provide stimulus to unleash the animal spirits of the entrepreneurs and the private sector, improve business sentiment, assure the citizens that the government is working on a long term growth plan for all sections of society and portray the government as fiscally responsible so as to provide the right environment for society to prosper and grow.

The expectation scale is lower of Indian businesses; all they seek is that the government should reduce the administrative burden oflaws, rules, compliances and filings in doing business. They just want continuity in policy and that, they should be largely left alone to do legitimate business and create wealth. They want the government to maintain law and order, enforce contracts and ensure that there is no undue harassment and tax terrorism. Someone rightly said, “most businesses grow at night when the government sleeps.”

However, Pre Budget, there seemed to be a consensus among business and finance experts that the 2020 Union Budget will do something truly innovative and reformist,to put India on the growth path, a la 1991. Based on this assumption and conforming sound bytes from the government, the Sensex soared by more than 10% to an all-time high of over 42,000.

Most investors suffer from what we call a conformation bias – which is essentially a type of cognitive bias that involves favouring information that confirms to your previously existing beliefs or biases. It leads people to hold strongly to false beliefs or to give more weight to information that supports their beliefs than is warranted by the evidence. This is precisely what happened pre budget, all investors believed in the hope, that the government will definitely provide the stimulus to the economy and electronic, print and social media strongly supported this view, which resulted in the Hope Rally.

Harvard psychologist Daniel Gilbert wrote a long time ago: “Humans are credulous creatures, who find it very easy to believe and very difficult to doubt. In fact, believing is so easy, and perhaps so inevitable, that it may be more like involuntary comprehension than it is like rational assessment.” Gilbert and colleagues showed through experiments that our first choice is to believe what we hear and read and that is exactly what happened Pre Budget.

Warren Buffet said,“You pay a very high price for a cheery consensus.” The post budget crash of nearly

1000points on Saturday drove home this point really hard for many investors and stock traders who were hopeful, absolutely without any basis.

Sticking to the old Warren Buffet saying definitely pays dividends, “Be greedy when others are fearful and fearful when others are greedy.” This has been proven once again as all the losses of the budget day fall have been recovered today even as I write this blog.

Coming back to the budget, now that the event is over, what exactly could have the government done and what is the way forward?

The problems ailing the economy today are well known; slowing growth, rising unemployment, poor business and consumer sentiment, rising inflation, virtually negligible incremental investment, contracting exports, declining saving and investment rate, high level of real interest rates, major fall in incremental credit growth and slowing consumption.

During a T 20 match, the captain sometimes sends a pinch hitter not only to increase the scoring rate but also to send a message to the opposition that he means business and to try that the most critical bowler of the opposition is used so that the other batsmen can capitalise on the weaker bowlers left.

Some may say that Economy is not a T 20, but a test match; but when a draw is not an option, you may have to take a calculated risk and go for a win rather than send Dravid to stabilise the innings for a draw to result.

Hence, The first thing which was required was a change in mindset and a sense of urgency. The powers to be have to get into a growth mindset and leave behind the socialist populist mindset of controls and monitoring, but the budget paper went against the ethos and recommendations of the economic survey. The mindset of shortages has to change to a mindset of abundance, as very well elaborated by Chetan Bhagat in a recent post budget article.(https://timesofindia.indiatimes.com/blogs/The-underage-optimist/immigrants-or-business-mentality-needs-to-change/)

What was required was strong structural reforms, innovative schemes to tap the resources and policies which convey that the government means business, will go all out and is ready to walk the talk to achieve the dream $ 5 Trillion economy by 2025.

Auto and real estate sectors are bleeding; they also have the maximum multiplier effect and are big employment generators both skilled and unskilled. No immediate relief or boost has been provided to these sectors.

Many commentators and analysts were recommending and expecting a TARP kind of relief to the ailing financial sector. The Troubled Asset Relief Program (TARP) was an initiative run by the U.S. Treasury to purchase toxic assets and equity from financial institutions to strengthen its financial sector and stabilize the country’s financial system, restore economic growth, and mitigate foreclosures in the wake of the 2008 financial crisis. However, no such relief is evident and the financial sector woes may continue much longer in the absence of TARP or a Bad bank or any such immediate relief.

We have all heard of $ 1.4 Trillion boost to infrastructure sector; but where is the money and resources for that. Some effort has been made in the form of relief to FIIs, concessions to Sovereign funds, deepening the bond market and by increasing limits; but will that be enough to tap the amount required to achieve the target? Something more could and should have been done.

During the US visit and subsequently too, The Hon’ble Prime Minister himself made statements that “we shall bring Equity taxation at par with the rest of the world” The markets thus expected relief on LTCG introduced in 2018 and complete withdrawal of DDT.

Compared to consumption growth in the range of 7% to 8.5% in the previous half years, the consumption growth in this year was only 4.1%. The consumption by Individuals was weak on account of reduced income growth, poor sentiment, reduced income, loss of jobs, high levels of unemployment, reduced competitiveness of SMEs and fear of regulatory action during purchase of high ticket items.

A boost to Consumption was expected to be provided in the budget by putting more money in the hands of people and increase in rural spends. The budget has made an effort by offering a higher personal income tax slab without exemptions, increased spend on rural infrastructure, though MNREGA has been ignored, and rise in government capex.

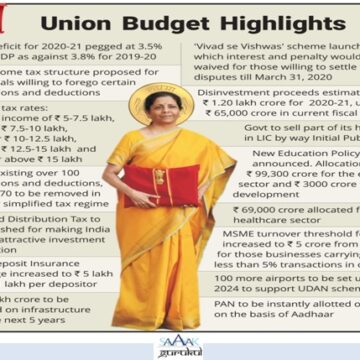

There have been some positives in the budget; a realistic nominal GDP growth projection, credible fiscal deficit numbers, vision and intent for GDP growth, increase in government capex, Freeing of the sovereign bond market for retail investors, waiver of taxes for investments in infrastructure by Sovereign wealth funds, relaxation in corporate bond schemes, scheme to resolve tax disputes, aggressive disinvestment target and LIC IPO, tax relief for individuals, increase in audit limits for MSMEs, introduction of the tax charter, and the government proposal to remove criminal liability for civil offences, and other such measures.

But, will these policies be enough to boost growth in the short term and sustain high levels of growth in the medium to long term. There has been a major expectation mismatch in the budget 2020.

There was an urgent need to go beyond good intentions and revive a slowing economy but it seems that it shall take a few more quarters before the potential can be reaped.

Meanwhile let us console ourselves by saying that we are still one of the fastest growing economies in the world and we shall get to a $5 Trillion economy by 2025, God willing.

Happy Investing!

Sandeep Sahni

Kindly check our earlier blog on a similar subject : Investment Lessons from Mythology at https://sahayakgurukul.blogspot.com/2019/03/investment-lessons-from-mythology.html OR https://www.sahayakassociates.in/resources/our-blog/2553-sahayak-associates/sahayak-associates-blog/8435-investment-lessons-from-mythology

Note: All information provided in this blog is for educational purposes only and does not constitute any professional advice or service. Readers are requested to consult a financial advisor before investing as investments are subject to Market Risks.About The author

About The author

Sandeep Sahni

After completing his schooling from St. Johns, Chandigarh (Class of 1980) and Modern School, New Delhi, (Class of 1982) Sandeep did his B. Com (Hons.) from Shri Ram College of Commerce, Delhi University (Class of 1985)

Sandeep is an alum of IIM Lucknow with a Post Graduate Degree (MBA class of 1988).

He has also written two books, ‘Dear Son, Life Lessons from a Father’on the teachings of Life https://www.amazon.in/dp/1637815271 and the Second book which he has Co Authored titled, ‘What My MBA Didn’t teach me about Money’ on the Human and Financial perspective of money. https://www.amazon.in/dp/1637816502

He has a rich work experience and started his career as a corporate man with Asian Paints after IIML. He has a rich experience covering the FMCG, Food Distribution, Cold Chain, Logistics, and Hospitality Industries. He is currently in the Wealth Management and Personal Finance domain. He has a passion for finance and is an active speaker on topics in finance. The stories he narrates strike a chord close to his heart, as they are based on events from his own life. He believes in a holistic view of Personal Finance.

Sandeep’s investing experience and study of the Financial Markets spans over 30 years. He is based in Chandigarh and is advising more than 500 clients across the globe on Financial Planning and Wealth Management.

He has promoted “Sahayak Gurukul” which is an attempt to share thoughts and knowledge on aspects related to Personal Finance and Wealth Management. Sahayak Gurukul provides financial insights into the markets, economy and Investments. Whether you are new to the personal finance domain or a professional looking to make your money work for you, the Sahayak Gurukul blogs and workshops are curated to demystify investing, simplify complex personal finance topics and help investors make better decisions about their money.

Alongside, Sandeep conducts regular Investor Awareness Programs and workshops for Training of Mutual Fund Distributors, and workshops and seminars on Financial Planning for Corporate groups, Teachers, Doctors and Other professionals.

Through his interactions and workshops, Sandeep works towards breaking the myths and illusions about money and finance.

His passion has driven him towards career counselling for young adults and mentoring the youngsters on achieving their life goals and becoming “Successful Humans”

He also writes a well-read blog; https://sahayakgurukul.blogspot.com

He has also conducted presentations, workshops and guest lectures at professional colleges and management institutes for students on Financial Planning and Wealth Creation.

He can be reached at:

+91-9888220088, 9814112988,

sandeepsahni@sahayakassociates.in

Follow on:

www.sahayakassociates.in,

www.facebook.com/sahayakassociates,

www.twitter.com/sahayakassociat,https://www.instagram.com/sahayakassociates/

https://sahayakgurukul.blogspot.com, https://www.sahayakassociates.in/resources/our-blog