As we approach the end of the year and the dawn of the New Year, the number crunching starts. Specifically, as the calendar year ends, we download raw data and try to decipher trends and patterns in the data. With the end of 2019 and the start of the new decade, let’sstartby reviewing the year gone by and the major learnings from the past year.

Despite all the talk and anguish about trade wars, geopolitics and a sputtering and overly indebted global economy, 2019 was one of the best year investors have ever had. Global stocks have increased by more than $10 trillion, bonds have been on fire, oil has surged almost 25 percent, former crisis spots Greece and Ukraine have top-performed, metals are on a comeback trail and even gold has outshone to cross $ 1500 an ounce.

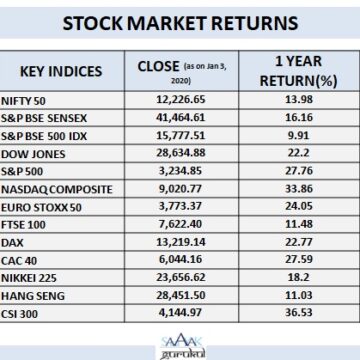

Wall Street and MSCI’s near 50-country world index have both touched record highs with 30 percent and 24 percent growth. Europe, Japan, China and Brazil are all up, at least 20 percent and that too in dollar terms.

Technology companies and the FAANG stocks (Facebook, Amazon, Apple, Netflix, and Google’s parent, Alphabet, which make up the so-called FAANG stocks)have remained the top performers. Apple may just have lost its crown as world’s most valuable firm tag to the Saudi new listing, Aramco, but it was still up 77 percent in 2019.

Facebook surged 57 percent, Microsoft 53 percent, Google 30 percent, Netflix 24 percent and Amazon 19 percent. China’s tech sector also went up with a 64 percent rally and online giant Alibabawas up 53 percent. The Indian tech sector performance totally pales in comparison.

In the Indian context, 2019 was a year of contrasts in many ways. While the economy slowed down sharply, equity markets did well as the Nifty and the Sensex delivered double digit growth. Yet within equities, broader markets didn’t do well with the Nifty Midcap 100 and the Nifty Smallcap 100 indices losing. Similar was the story in debt markets, even with a 135-bps cut in policy rates by the RBI, rate transmission did not happen. Term premium stayed elevated until the RBI intervened with ‘Operation Twist’, whereby RBI bought long-dated securities and sold short-dated securities. Overall, while g-sec funds did well thanks to an 81bps decline in 10-year yields, credit spreads stay elevated.

Till December 27, the NIFTY 50 had gained 13.47 per cent for the calendar year. However, the broader market continued to bleed and the NIFTY Mid-cap index corrected by 3.82 per cent. The NIFTY Small-Cap index fared worse and slipped 11.38 per cent for the year. The NIFTY 500 TRI was however up by 9.15%. The sectoral indices, i.e. Nifty Auto, Pharma & FMCG were all down except Nifty Bank which is up 19.27 per cent.

Most analysts are calling this dichotomy in Indian markets a “Narrow Bull & Broader Bear Market.”The top 10 Nifty stocks contributed to the entire gains of Nifty in 2019. 24 Stocks in the Nifty 50 delivered negative returns.

In 2019, world economic growth (at market exchange rates) slowed to 2.5 per cent, essentially because of a slowdown in three big economies. The growth of the $21-trillion US economy slowed to 2.4 per cent, that of $19-trillion European Union (EU) to 1.5 per cent and $14-trillion China to 6.1 per cent. Together, these “big 3” account for over 60 per cent of world GDP. Amongst others, the major causes of the slowdown are the waning of the tax-cut stimulus in the US, the major trade wars, high total debt in China and a sharp slowdown in EU’s main engine, Germany.

In the six quarters to September 2019, India’s economic growth has slumped from 8 per cent to 4.5 per cent and the government now expects full fiscal year 2019-20 growth to only be 5 per cent, the lowest in a decade. Though the underlying causes of the slowdown are widely debated, opinions also vary whether the slowdown is cyclical or structural in nature.The main causes of the sharp slowdown are thecontinuing high stress in the financial sector, high public sector borrowings, which have subdued private investment; poor sentimentleading to low consumption growth; a falling share of exports to GDP because of declining competitiveness and failure to plug into global value chains; a sharp slowdown in manufacturing; and major problems in key service sectors such as telecom, aviation and power.

As against a better than expected World GDP growth and record world stock markets growth, India has badly underperformed. Due to concerns of India’s poor economic growth and weak corporate earnings, the Indian stock market has been among the worst performing market in 2019.

The Indian stock market also remained volatile for the better part of 2019 on account of drag in corporate earnings, debt defaults, volatile oil prices, escalating trade tensions between the U.S. and China, a weaker rupee and liquidity crisis among NBFC’s.

However, the disconnect between the state of the Indian Economy and equity markets has been quite disconcerting. The main reasons forlow economic and earning growth but Index scaling new highs has been

a) The global Reflation policy with majority global central banks, including the US Fed, following expansionary monetary policies.

b) Stocks are forward looking and are pricing in a likely economic recovery, aided by factors such as ample liquidity, agriculture inflation along with good monsoons and improved Rabi sowing, and lagged impact of lower interest rates.

c) Most importantly, the current economic crisis has set the tone for the much-needed meaningful reform initiatives by the Government which shall have a long-term impact and lead to sustainable development and growth.

2019 was a year, which also taught us some great overdue investment lessons.

- Markets and economic growth may not move in the same direction. Markets move ahead of earnings.

- 2019 showed us that how despite the Index touching new Highs, the total market cap can still be negative sowing how the broader market can underperform.

- Blue chips continued to outpace the broader market for the second straight year in Calendar 2019. The markets and money moved to quality stocks and safe haven making their valuations touch record levels.

- We learnt that small &mid-caps can actually go down considerably for two consecutive years by double digits and lose most of their premium over large Caps.

- We also learnt that markets don’t tolerate mis governance and even a whiff of bad governance is punished considerably by the market.

- 2019 also taught us the risks associated with debt funds and that they are not fixed deposits, returns are not assured, and they can also face a default risk. The credit ratings can swiftly move from AAA to D without any qualms or clarifications.

- We also learnt that an out of favour asset class like real estate can consistently underperform and go through a major cycle before revival.

- 2019 also highlighted the vulnerability of the Indian Economy to global headwinds and the impact it can have on both earnings and sentiment.

- 2019 will also go down possibly as the year in which the FII withdrawals and outflows lost their impact and were countered with the consistent DII inflows.

- 2019 was also the year in which the market taught the investors and reinforced the meaning of risk in different asset classes.

- Another Lesson from 2019 was Don’t love the stocks you own; every loser is not a rebound story. Sometimes, low-level buying without proper research can lead to further wealth destruction in the equity market. This is the biggest lesson Dalal Street taught in Calendar 2019.

- 2019 also reinforced the age-old importance of Asset allocation and the need to optimize risk in a portfolio.

- 2019 also taught the importance of Gold in the Portfolio and how Gold is the perfect hedge for equity. Gold not only outperformed in 2019 with a 24% rise but Gold investors have reaped slightly better returns than investors in stock market this decade. BSE Sensex has appreciated by 130% in the last 10 years, but gold has outdone it with 134% returns.

- 2019 also made the government finally realise the enormity of the growth problem and economic slowdown and take corrective policy measures so as to spur growth and also to improve sentiment and investment climate.

Going ahead, analysts say the market will be driven by macro-economic tailwinds. Receding global trade war fears, continuity of enabling government policies and reforms, Continuous government stimulus and tax reforms on equity investments, benefits of low-tax structures for corporates, good monsoon, low-interest rate regime, the low base of CY19 will turn sentiment around, leading to higher consumption. Improving economic outlook along with favourable policies should also see FPIs returning. The continuous liquidity support of DIIs and specifically Mutual funds inflows shall also help the markets.

Markets look at 2020 with optimism about a cyclical economic recovery and earnings uptick.2020 is not for predicting returns but accumulation, asthe broader markets is fairly valued and readying for take-off.

Pundits will always try and call the market’s direction, but a wise man once very aptly said, “When the market’s going down, it’s not because you are stupid and when it is going up, it’s not because you are smart.”

Don’t try to time the market; As the veteran investor said, “Invest when you have the money, redeem when you need the money and your timing will be perfect.”

There is no point sitting on the sidelines and waiting for the stock markets to pick up before you start investing. Peter Lynch has aptly said, “More money has been lost in waiting for the correction to happen, than in the correction itself.”

Consult your Financial advisor, follow your asset allocation strategy, review against your financial goals, continue your SIPs, invest your lumpsum through a STP from an arbitrage fund and you would have made the right decisions in 2020.

Have a Great & profitable Investment year ahead!

Happy Investing!

Sandeep Sahni

Kindly check our earlier blog on a similar subject : Investment Lessons from Mythology at https://sahayakgurukul.blogspot.com/2019/03/investment-lessons-from-mythology.html OR https://www.sahayakassociates.in/resources/our-blog/2553-sahayak-associates/sahayak-associates-blog/8435-investment-lessons-from-mythology

Note: All information provided in this blog is for educational purposes only and does not constitute any professional advice or service. Readers are requested to consult a financial advisor before investing as investments are subject to Market Risks.About The author

About The author

Sandeep Sahni

After completing his schooling from St. Johns, Chandigarh (Class of 1980) and Modern School, New Delhi, (Class of 1982) Sandeep did his B. Com (Hons.) from Shri Ram College of Commerce, Delhi University (Class of 1985)

Sandeep is an alum of IIM Lucknow with a Post Graduate Degree (MBA class of 1988).

He has also written two books, ‘Dear Son, Life Lessons from a Father’on the teachings of Life https://www.amazon.in/dp/1637815271 and the Second book which he has Co Authored titled, ‘What My MBA Didn’t teach me about Money’ on the Human and Financial perspective of money. https://www.amazon.in/dp/1637816502

He has a rich work experience and started his career as a corporate man with Asian Paints after IIML. He has a rich experience covering the FMCG, Food Distribution, Cold Chain, Logistics, and Hospitality Industries. He is currently in the Wealth Management and Personal Finance domain. He has a passion for finance and is an active speaker on topics in finance. The stories he narrates strike a chord close to his heart, as they are based on events from his own life. He believes in a holistic view of Personal Finance.

Sandeep’s investing experience and study of the Financial Markets spans over 30 years. He is based in Chandigarh and is advising more than 500 clients across the globe on Financial Planning and Wealth Management.

He has promoted “Sahayak Gurukul” which is an attempt to share thoughts and knowledge on aspects related to Personal Finance and Wealth Management. Sahayak Gurukul provides financial insights into the markets, economy and Investments. Whether you are new to the personal finance domain or a professional looking to make your money work for you, the Sahayak Gurukul blogs and workshops are curated to demystify investing, simplify complex personal finance topics and help investors make better decisions about their money.

Alongside, Sandeep conducts regular Investor Awareness Programs and workshops for Training of Mutual Fund Distributors, and workshops and seminars on Financial Planning for Corporate groups, Teachers, Doctors and Other professionals.

Through his interactions and workshops, Sandeep works towards breaking the myths and illusions about money and finance.

His passion has driven him towards career counselling for young adults and mentoring the youngsters on achieving their life goals and becoming “Successful Humans”

He also writes a well-read blog; https://sahayakgurukul.blogspot.com

He has also conducted presentations, workshops and guest lectures at professional colleges and management institutes for students on Financial Planning and Wealth Creation.

He can be reached at:

+91-9888220088, 9814112988,

sandeepsahni@sahayakassociates.in

Follow on:

www.sahayakassociates.in,

www.facebook.com/sahayakassociates,

www.twitter.com/sahayakassociat,https://www.instagram.com/sahayakassociates/

https://sahayakgurukul.blogspot.com, https://www.sahayakassociates.in/resources/our-blog