You have spent 30 years working. To really enjoy the next experience, you now need to plan for 30 years of your retirement.

Do you know, that you are likely to live longer and healthier as compared to the previous generation?

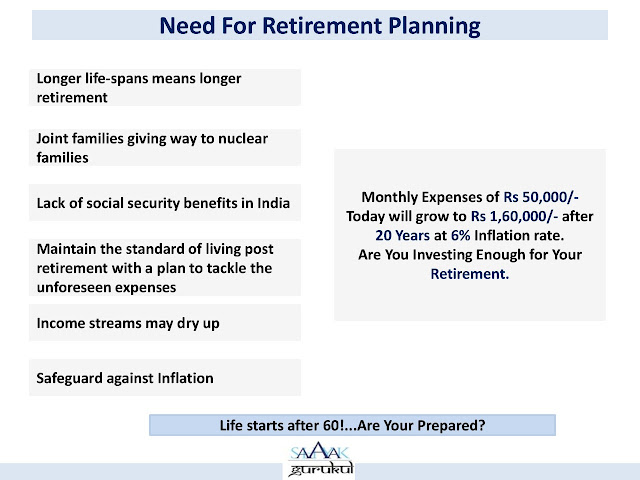

Do you know that your standard and cost of living will keep on increasing after retirement whereas your risk taking ability and resultant returns will come down?

Do you know that inflation & taxation will be the silent corpus killers?

Not many of us are financially prepared for our life after retirement. The HSBC Future of Retirement Study found that while 76% of working age people in India expect a comfortable retired life, only 33% are actually putting aside money to fund that phase of life. Over two thirds of working age people expect to keep working in some form, in the early and active years of retirement. However, concerns about affording care in retirement are common, 64% are worried about the rising cost of healthcare, 51% worry about not being able to afford home care, 49% feel they have to rely on others for support, 51% feel they could run out of money in retirement and 58% think they will not be able to live comfortably.68% of working age people expect their children to support them at some point in their retirement. However, Receiving financial support from children may be an unrealistic expectation.

Retirement is a major life transition – along with with marriage, buying a house, having children etc.

Times are changing, earlier retirement meant a maximum balance life span of another 10 years, settling down quietly and going on a pilgrimage.

Today, Sixty is the new Forty; it means travelling the world, pursuing hobbies and enjoying life to the fullest. – Retirement is now a period of relaxation; time to fulfill the remaining dreams of life, to do all the things you always wanted to do, but were somehow left unattended.

However harsh it may sound, the ability to fulfill all these desires hangs primarily on the availability of money and a sufficient corpus to outlast you and your spouse, apart from what you want to bequeath.

Hence, the acute need for retirement planning.

The first thing you need to do, is understand and plan your retirement spending, quantify your expense requirements and differentiate between Needs and Wants, and budget for the same.

Needs are essentials like food, Clothing, Healthcare, Insurance premiums, Mortgage payments if any.

Wants are discretionary expenses like travel, Entertainment, Club Membership, purchase of luxury goods, Charity etc.

Think about the kind of retirement you want. Envision your retirement, establish a retirement budget and monthly expense required to maintain a standard of living that you want to enjoy. Keep in mind, inflation, taxation and the reduction in your risk taking ability going forward.

Inflation is most important and needs to be accounted for because it will lead to major increase in expenses.

Healthcare expenses are important and not everything is covered by Health Insurance. Insurance premium, your regular medicines, health supplements, Diagnostic tests, Dental expenses and non-hospitalization Health care have to be paid for and can cost quite a sum.

Next comes, expenses on entertainment, eating out, Travel for family matters and leisure, Gifts, repair and maintenance of house, replacement of vehicle and gadgets. On an annual basis, expenses on these discretionary items can be as much if not more than the expense on essentials.

Some of the thing we assume, we won’t need to do, but technology forces us to replace expensive gadgets. Won’t you like to replace your oil guzzler with a slick electric vehicle?

Hence, you need to draw a budget of expenses, at current cost and project them going forward and estimate the corpus you require to generate, the desired income to meet those expenses.

Essentially, for a 50 year old, retiring in 15 years, with a current monthly expense of Rs 1 lacs, will need a corpus of close to Rs 10 cr at the time of retirement to maintain the same standard of living as today. With inflation @ 8%, his monthly expenses would have grown to Rs 3.17 lacs.

Next, at the time of retirement, apart from a corpus to meet your monthly expense, you need to have an Emergency Corpus to meet any contingency or emergency that may arise. In no case should the main corpus be touched or you may suddenly find yourself running out of money at an advanced age and may have to compromise or enter into a reverse mortgage to meet your daily needs.

As a benchmark, the Emergency corpus needs to be 50-100 times your monthly expense.

A lot of investors we talk to, make some very common retirement mistakes and then have to suffer the consequences.

Once you have decided on the corpus required, the next most important thing is to follow a sound asset allocation strategy based on your goals and time horizon. Nearing retirement and your goal, you need to reduce the risk and volatility of your corpus.

Asset Allocation is important so that a sudden market correction may not lead to a greater reduction in corpus size.

However your asset allocation strategy should take into account a balanced approach. The most important factor to keep in mind is that post tax returns from your corpus should be able to beat inflation. In case that does not happen, you may suddenly find that you have outlived your corpus as illustrated below, leading to major problems in your later life.

Investment is not all about quantitative techniques and numbers. The most common biases in human behavior are the ones related to our money and investment habits. When it comes to money and investing, we’re not always as rational as we think we are. Most economic theory is based on the belief that individuals behave in a rational manner and that all existing information is embedded in the investment process but human emotions influence investors in their decision-making process.

Hence, we strongly recommend that you consult a financial advisor for all your investment related matters; someone who has completeknowledge and expertise of various modes of investments. A good advisor will ensure that you do not make emotional decisions related to money and your investments and the volatility in various asset classes doesn’t influence your investment behavior.

He will also help you monitor, evaluate and make periodic changes to your portfolio based on your needs and financial goals.

Consult your financial advisor, enjoy your investment journey and achieve your Retirement Goals.

Happy Investing!

Stay Blessed Forever,

Sandeep Sahni